Having our own home is a milestone we all wish to cross in our lives. Many of us succeed in doing so early with the correct guidance and financial planning, while some fail to achieve it even when they turn 50.

Poor financial planning and management result in overspending, lower credit scores, social and personal issues, debts, etc. It severely affects our living standards. However, do not be disheartened! We can certainly buy a house using effective financial planning and allocating funds for personal finances.

How? Read on to learn the crucial requirement of financial planning and how we can buy a house at the early age of 30!

Role of Financial Planning in Owning a House

We invest in a house to become independent adults. However, our financial condition is the first and foremost factor signifying if we are ready to buy a home.

Why is it so?

Home is where we will be living for quite some time; besides being a financial investment, it is also an emotional one. It requires precise financial planning, asset allocation, or home loans- or maybe a combination of all, to purchase a house.

As a financial expert, Dave Ramsey said, “Going into debt usually isn’t caused by a lack of money; it is a lack of vision.”

Understanding the importance of financial planning while considering buying a home is crucial. Adequate financial planning helps not only in purchasing a place we can call our own but also aids in supporting present-day needs and meeting our daily requirements while crafting a safe nest for our long-term goals like retirement. It helps in capital accumulation by enabling us to invest in real estate at an early age with a process.

Moreover, it can assist in meeting the home loan eligibility criteria by eliminating the previous credits, refining our expenses, saving regularly, etc. Investors also need to seek proper literature to ensure that they are well-educated on the basics of personal finance.

Anyone thinking buying a house at an early age is a bad idea, let me make you aware of the perks it carries:

- Create a lifelong security

- Eligible for tax deductions on home loans

- Home loans with a tenure of 20-25 years and lower EMIs

- Capital appreciation advantages

Did you know?

Millennials represent 43% of buyers, making them the largest generation of home buyers.

How to Buy a House at 30?

Buying a house at 30 with accurate financial planning is one of the best investments. Besides nurturing a responsible attribute, it also aids in enhancing wealth over time. In reality, the more we delay the process, the more we expose ourselves to the higher prices that the future holds for purchasing a home.

Additionally, buying a house accompanies registration fees, stamp duty charges, parking charges, etc.; hence, we must do financial planning after considering these aspects. However, where should we look to collect money to make a substantial investment in a house? Well! Here’s a perfect investment plan you can implement from this very day to turn your dream into reality:

1. Calculate the Amount for the Dream House

Most of us decide early on the kind of house we want in our life. Usually, everything is perfect until we get to know the price of our dream house, and the bubble bursts, sending us back to the bitter reality. This is where we get our first crucial step! The primary step when looking to purchase a home is determining how much money we will need to do so.

Remember to add the additional costs to the total amount we will need. Assuming I want to buy a house, after considering the extra charges, I will take into account the inflation rate in real estate. With inflation touching new peaks every day, it becomes critical to include it as it influences the prices.

The average cost of a house rises with each passing day. If I have my eyes on a house rating of ₹70 lakhs today, I must gather at least ₹1 crore to be able to buy it in the next few years.

2. How Much Will I Need?

The first option that comes to our mind to get the leftover funds for purchasing something is borrowing, correct? It is the same for many people. Banks and non-banking financial companies provide home loans to help us buy homes. However, banks do not give all the amount needed to invest in the house.

Banks can offer us a home loan of up to 80% of the property’s value. And this remaining 20% of the property’s price must come out of our pockets, despite availing of a home loan. Banks give home loans once we pay the down payment.

The ideal way to buy a house is to pay 60% of the property’s purchase price from our pockets, leaving the rest on a home loan. Using our own funds to purchase the house limits the interest cost and saves us from massive chunks of EMI.

Going with our example that I need ₹1 crore, it implies that I can borrow home loans up to ₹80 lakhs. But, this loan will accompany a larger EMI. Hence, it will be better to accumulate a sizable corpus to make a high down payment and reduce the EMI.

Does paying a higher down payment really help? Let’s find out!

| When the down payment is higher than the home loan | When the down payment is lower than the home loan | |

| Loan | ₹40 lakhs | ₹80 lakhs |

| Tenure | 20 years | 20 years |

| Interest rate | 8% | 8% |

| EMI | ₹33,458 | ₹66,915 |

| Interest payable | ₹40.30 lakhs | ₹80.60 lakh |

| Payments made over the loan term | ₹80.30 lakhs | ₹1.60 crore |

3. Monthly Investment Amount to Acquire Down Payment

Now that we know how much we should collect for the down payment, it is time to determine the monthly investment amount. We must devise a strategy to figure out the corpus for investments that will do the trick before making any unplanned investment.

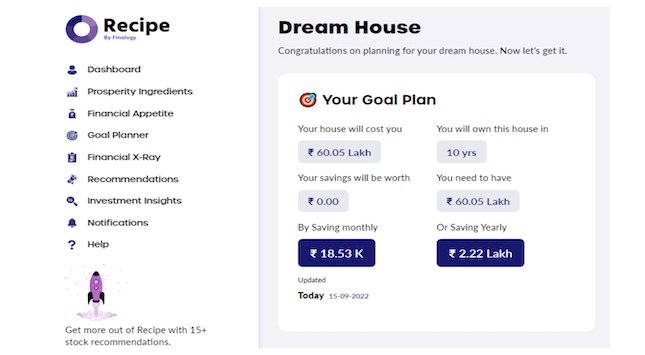

We must know how much time we have to collect the said amount monthly. Let’s say I have ten years to gather ₹60 lakhs for the down payment. I will invest depending on the return rates and duration. For instance,

The screenshot from Recipe by Finology shows that with the duration being ten years and annual interest rates of 12%, I can accrue ₹60 lakhs by investing ₹18,530 monthly.

Some might find ₹26,000 is too much to invest; no worries! We can start with a lesser amount and increase it yearly. How? With SIP! What is it? A systematic investment plan allows us to invest a fixed amount regularly in mutual fund schemes.

In simple words, we can make regular investments in mutual funds and increase the amount annually to accumulate adequate funds. I can accrue my down payment if I invest ₹20,000 with a 10% yearly increase in SIP.

4. Where Should I Invest: Equity or Debts?

Investing in a house is a long-term goal. We can not up and change it because we feel like it. That is why we must find the perfect investment opportunities to gather funds. Equities, owing to their long-term positive attributes, are a better companion when looking for a chance to collect money.

They come with little to no risk with a guarantee of repayments. Equities offer higher returns to investors as a result of the greater risk associated with the instrument. A downfall in the company’s profit or finances will reduce our chances of acquiring higher gains.

To get a better understanding of the financial markets, investors should engage in consuming the proper literature to stay educated. Quest by Finology provides a wide range of courses for new and seasoned investors alike.

You May Like to Read: Financial Planning for Home Sellers

Conclusion

Purchasing a home does not have to be a hassle. Irrespective of what anyone thinks, it is optimal to conduct some goal planning before achieving something. Moreover, it is never too late to walk on the right path! Investments made with accurate financial planning turn out to be an impeccable option we can choose when searching for ways to accumulate funds.

Professionals and online platforms with investor education can assist us in making successful investments to gather money timely for our dream house. Besides, it is never too early to start cherishing the positives of homeownership.

Have you crossed 30 and are still wondering whether financial planning is worth it? (It absolutely is!) When do you think is the ideal time to buy a home, and why? Let us know in the comments!